This Act provides that properties owned by the Riverfront Development Corporation of Delaware are exempt from taxation. The Riverfront Development Corporation of Delaware is an entity created by State law for purposes of planning and development of the area along the Brandywine and Christina Rivers. Removing tax burdens from the Riverfront Development Corporation of Delaware will enable it to better engage in its development efforts, including attracting other investors and tenants, and ultimately promote the common good of the citizens of this State.

Senate Bill 330

Legislative Highlights

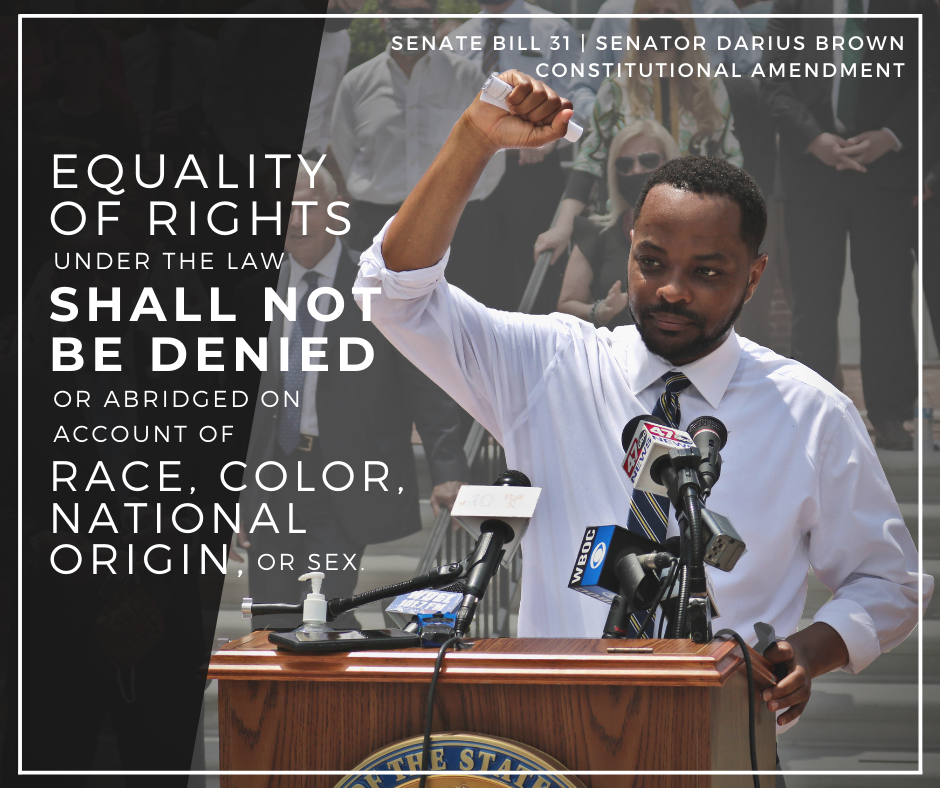

Senate Bill 31

The first bill in the Delaware Legislative Black Caucus’s Justice for All Agenda enacted into law by the General Assembly, the Equal Rights Amendment to the Delaware Constitution marked a meaningful step on the long road toward addressing the original […]

Senate Bill 32

Passed unanimously by the General Assembly, the Delaware Crown Act (Create a Respectful and Open World for Natural Hair) protected people of color from facing discrimination due to their braids, locs, twists and other hairstyles or hair textures historically associated […]

Senate Bill 111

The Clean Slate Act continued the restorative justice work of Senator Darius Brown by building on the success of the Adult Expungement Reform Act of 2019, which significantly expanded the availability of expungements to Delawareans beyond the previously narrow population […]

Senate Bill 28

Senate Bill 28, introduced by Senator Darius Brown will provide $7,000 towards funeral expenses for deceased members of volunteer fire companies, ladies’ auxiliaries, and volunteer ambulance and rescue companies. The majority of Delaware fire companies are powered by volunteers, with […]