This Act is identical to Senate Substitute No. 1 to Senate Bill No. 9, which establishes new formulas that a community owner is allowed use to increase rent in a manufactured home community. The requirements under this Act will be in effect for 5 years, during which time the current requirements for rent increases in manufactured home communities will be suspended. Under current law, rent increases in manufactured home communities have frequently been the subject of arbitration hearings and lengthy court cases. This Act seeks to dramatically reduce or eliminate these disputes by providing a choice of 3 methods that a community owner can use to establish the amount of a rent increase. In addition, when rent is increased based on 1 of the new calculations, this Act establishes clear standards and requirements, including documentation that requirements have been satisfied. This Act applies to rent increases when notice is provided beginning the 1st day of the month following its enactment into law, and remains in effect until 5 years after its enactment. Under § 7052 of Title 25, rent in a manufactured home community can be increased in an amount greater than the percentage increase of the Consumer Price Index for All Urban Consumers (CPI-U) for the preceding 36 months if there have not been health or safety violations that persisted for more than 15 days, the rent increase is directly related to operating, maintaining, or improving the manufactured home community, and the rent increase is justified by 1 or more of the factors listed, which include capital improvements, changes in taxes, utility charges, insurance costs, operating and maintenance expenses, repairs, and market rent. Rent increases under § 7052 are subject to additional requirements and the dispute resolution process under § 7053 of Title 25. Under this Act, § 7052 will not apply to rent increases while the new methods for calculating rent increases are in effect. Under this Act, a community owner may increase rent based upon the increase in the CPI-U for the preceding 24 months, based on market rent, or by agreement with a homeowner for a period of more than 1 year. In addition, a community owner may increase rent based upon the increase in the cost of specific expenses. Increases based on market rent or these additional expenses are subject to the requirements and dispute resolution process under § 7053. This Act requires that in order to increase rent, there cannot have been a health or safety violation that continued for more than 15 days as calculated under § 7051A of Title 25 or if there is a health or safety violation, the community owner must provide a surety bond or letter of credit in an amount sufficient to fund 100% of the rent increase in addition to written documentation of how the violation will be corrected by a specified date. If the violation is not corrected by that date, the surety bond or letter of credit will be used to refund the rent increase to homeowners. This Act also creates a limited eligibility lot rental assistance program for homeowners whose incomes are between 40% and 55% of the county median household income that applies to rent increases. Specifically, this Act does all of the following: Section 1. Moves definitions of the terms “CPI-U” and “market rent” to § 7003 of Title 25 because the terms are used in more than 1 section. This Act also updates the definition of “CPI-U” to reference the Philadelphia-Camden-Wilmington region. Section 2. Adds detailed notice requirements to § 7051 of Title 25 that require written notice of a rent increase at least 90 days, but not more than 120 days, before the first day the increased amount of rent is due and that this notice must be sent to each affected homeowner, the homeowners’ association, if one exists, and the Delaware Manufactured Home Relocation Authority (DEHMRA). Section 3. Revises § 7052 so that it applies to rent increases that occurred or were noticed between the date § 7052 was enacted and the effective date of this Act. It makes corresponding changes to the subsection designations and repeals the definition of “market rent” because that definition will be in § 7003. Section 4. Establishes the requirements for rent increases for the 5 years after this Act takes effect, by creating the following: • § 7051A of Title 25, which establishes the prerequisites regarding health or safety violations that must be satisfied before rent can be increased including the requirement that if a health or safety violation has continued for more than 15 days as calculated under § 7051A of Title 25, the community owner must not only document that the violation will be correct by a specific date within 1 year, but must provide DEHMRA with a surety bond or letter of credit in an amount sufficient to fund 100% of the rent increase. If the violation is not corrected by that date, the surety bond or letter of credit will be used to refund the rent increase to homeowners. This Act clarifies that “violation” includes requirements under federal, state, or county laws and that if the community owner does not correct the specified date, the rent increase does not take effect. • Creates § 7052A of Title 25, which establishes the following 3 ways that a community owner may establish a base rent increase: 1. Based upon the increase in the CPI-U for the preceding 24 months. 2. Based on market rent 3. By agreement with a homeowner for a period of more than 1 year. • This Act also clarifies that § 7052A continues to apply to rent increased under the section after the section sunsets, revises the definition of the “24-month CPI-U” to mirror the language in § 7053 of Title 25, and clarifies the language explaining the rent increase calculation if based on a 24-month CPI-U that is equal to or below 7%. • Creates § 7052B of Title 25, which establishes the requirements under which a community owner may add an additional rent increase to an increase under § 7052A. The requirements include the specific allowed expenses that can be the basis of an additional rent increase, the time periods that are used in the calculations, the calculation used to determine if an additional rent increase is permitted, and how the dollar amount of an additional rent increase is calculated. A community owner must provide documentation of the cost of each of the allowed expenses on a website and must provide paper copies for review at the management office and upon request by a homeowner. Section 5. Makes the following corresponding changes to § 7053: 1. Repeals notice provisions that will be in § 7051 and applicable to all rent increases in manufactured home communities. 2. States that this section is applicable to rent increases under §§ 7052, 7052A(d), and 7052B of Title 25. 3. Revises subsection (j) so it includes the standards under §§ 7052A(d) and 7052B, if applicable. Section 6. Makes a technical correction to § 7054 of Title 25 so that it references § 7053 of Title 25 where it provides the deadline to appeal a decision of an arbitrator. Section 7. Revises the lot rental assistance program by doing the following: • Revises § 7022 of Title 25, the current lot rental assistance program, by doing the following: 1. Expands eligibility by requiring residency in the home for 5 consecutive years, instead of prior to July 1, 2006. 2. Increasing eligibility to households with income that is equal to or less than 40% of the county median income, from the current 30%. This Act also updates which agency that determines the county median household income. 3. Repealing subsections that are being transferred to a new § 7022A of Title 25 because the provisions also apply to the new limited eligibility lot rental assistance program. 4. Making technical corrections to conform existing law to the standards of the Delaware Legislative Drafting Manual. • Creates § 7022A of Title 25, which has the requirements that apply to the lot rental assistance programs under both §§ 7022 and 7022B of Title 25. These requirements are transferred from § 7022A with only technical corrections. • Creates § 7022B of Title 25, which creates a limited eligibility lot rental assistance program for homeowners whose incomes are between 40% and 55% of the median household income that applies to rent increases. Under this program, a homeowner’s rent is calculated on a sliding scale based on the amount of the household’s income. This Act also does all of the following: 1. Expands eligibility for the limited eligibility lot rental assistance program to lot rent increases that take effect after the effective date of this Act. 2. Revises the eligibility requirements to correct a drafting error. 3. Requires residency in the home for 5 consecutive years to be eligible. 4. Corrects which agency determines the county median household income. 5. Clarifies how rent is calculated under the limited eligibility lot rental assistance program. Sections 8 through 10 require that if any of the following find a violation of a health or safety requirement in a manufactured home community, notice must be provided to local and state elected officials, the Department of Justice, and the Authority: 1. A county government. 2. The Department of Health and Social Services, for drinking water. 3. The Department of Natural Resources and Environmental Control. In addition, Sections 8 through 10 make technical corrections to conform existing law to the standards of the Delaware Legislative Drafting Manual, including the correction of an internal reference in § 122(3)c.E. of Title 16. Section 11. Makes this Act effective on the first day of the month following its enactment into law.

Senate Bill 317

Legislative Highlights

Senate Bill 15

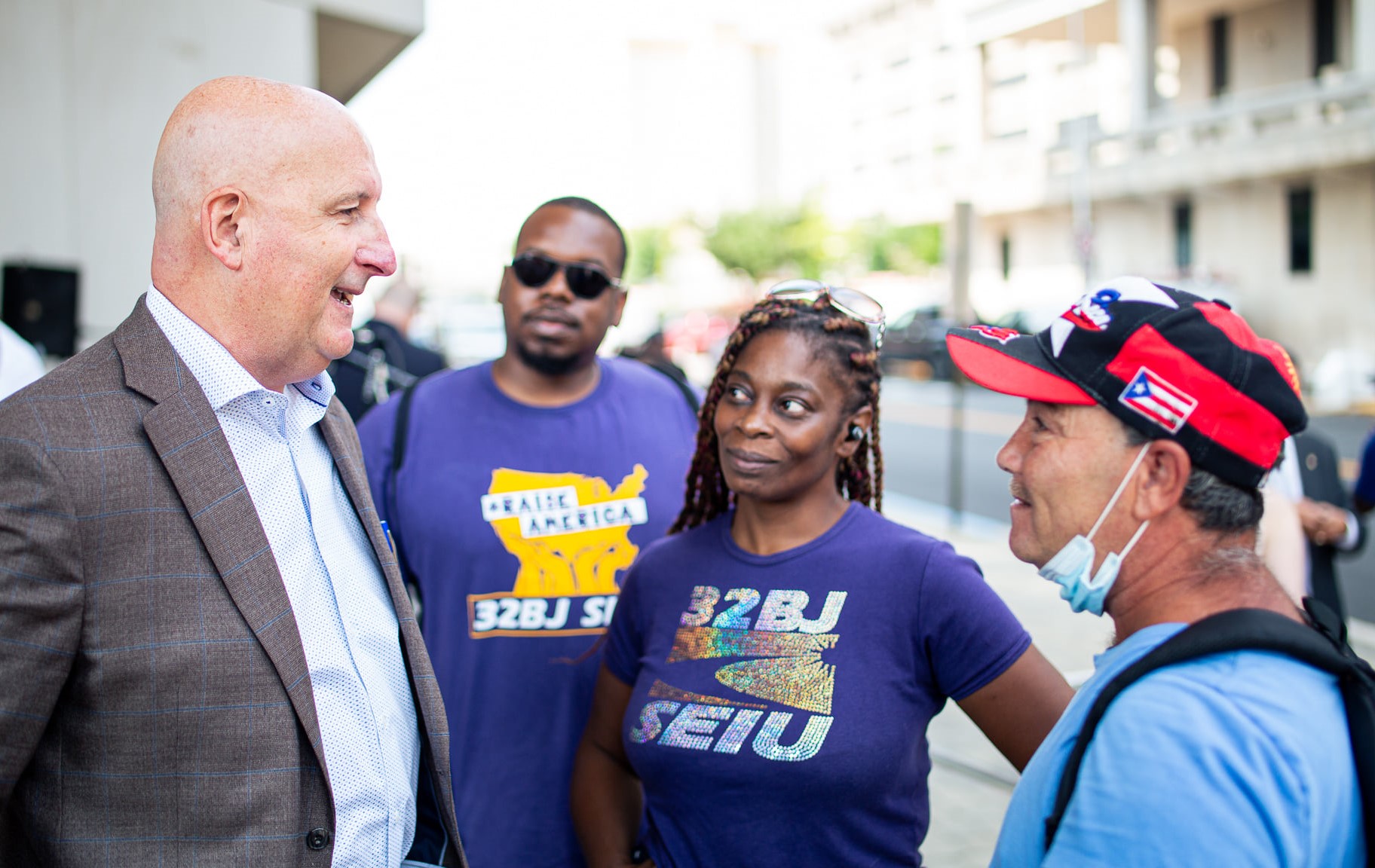

Thousands of working families have been lifted out of poverty thanks to legislation passed by Sen. Jack Walsh that continues to gradually increase Delaware’s minimum wage to $15 an hour by 2025. Under Senate Bill 15, Delaware’s base wage rose […]

Senate Bill 200

The Joint Committee on Capital Improvement (Bond Committee), composed of members from both the House and Senate, successfully passed SB 200 as part of the FY 2026 Bond and Capital Improvements Act. Introduced by Senator Jack Walsh, chair of the […]

Senate Bill 127

Sen. Jack Walsh helped to bring hundreds of good-paying, new jobs to Delaware by creating a Site Readiness Fund that is helping to convert abandoned commercial and industrial sites for reuse by new employers. Passed with overwhelming bipartisan support, Senate […]

Senate Bill 35 (S)

Sen. Jack Walsh enacted new laws to crack down on companies that try to pay Delaware workers less than they are owed or avoid paying their fair share of state payroll taxes. Passed with bipartisan support, Senate Bill 35 (S) […]